Thoughts on Insuring Alchemix

Discussing an insurance coverage for Alchemix vaults to enable the onboarding of new users who may be concerned about smart contract risks within Alchemix and Yearn.

Intro to Nexus Mutual

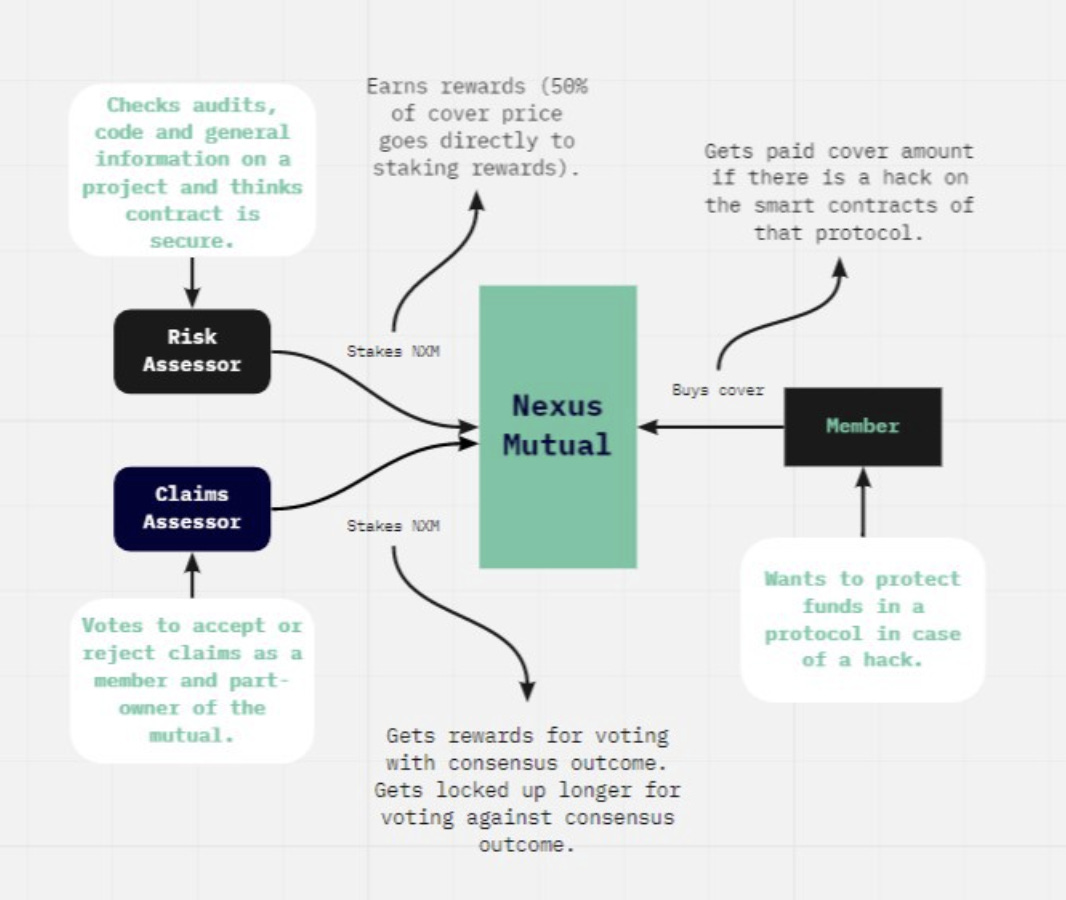

Nexus Mutual is a decentralised alternative to insurance. They used blockchain technology to create a mutual (a risk sharing pool) to return the power of insurance to the people.

Nexus works as a cooperative, members can stake against the security of a smart contract and get rewarded for their staking. Enough staking needs to happen before anyone can purchase cover on that smart contract.

When Nexus Mutual is alerted to a claim, members will be asked to vote on whether to pay out on that claim or not. Claims should be resolved within 12-48 hours.

The NXM token represents membership rights in the mutual, with all members owning the mutual together. It can only be bought and sold with the Nexus Mutual application. Only members of Nexus Mutual can hold NXM tokens.

Another interesting strategy by Nexus Mutual is Shield Mining, basically protocols that want Nexus Mutual members to stake against their cover offer these people tokens in exchange for that trust to incentivise that the cover gets a bigger volume.

Intro to Alchemix

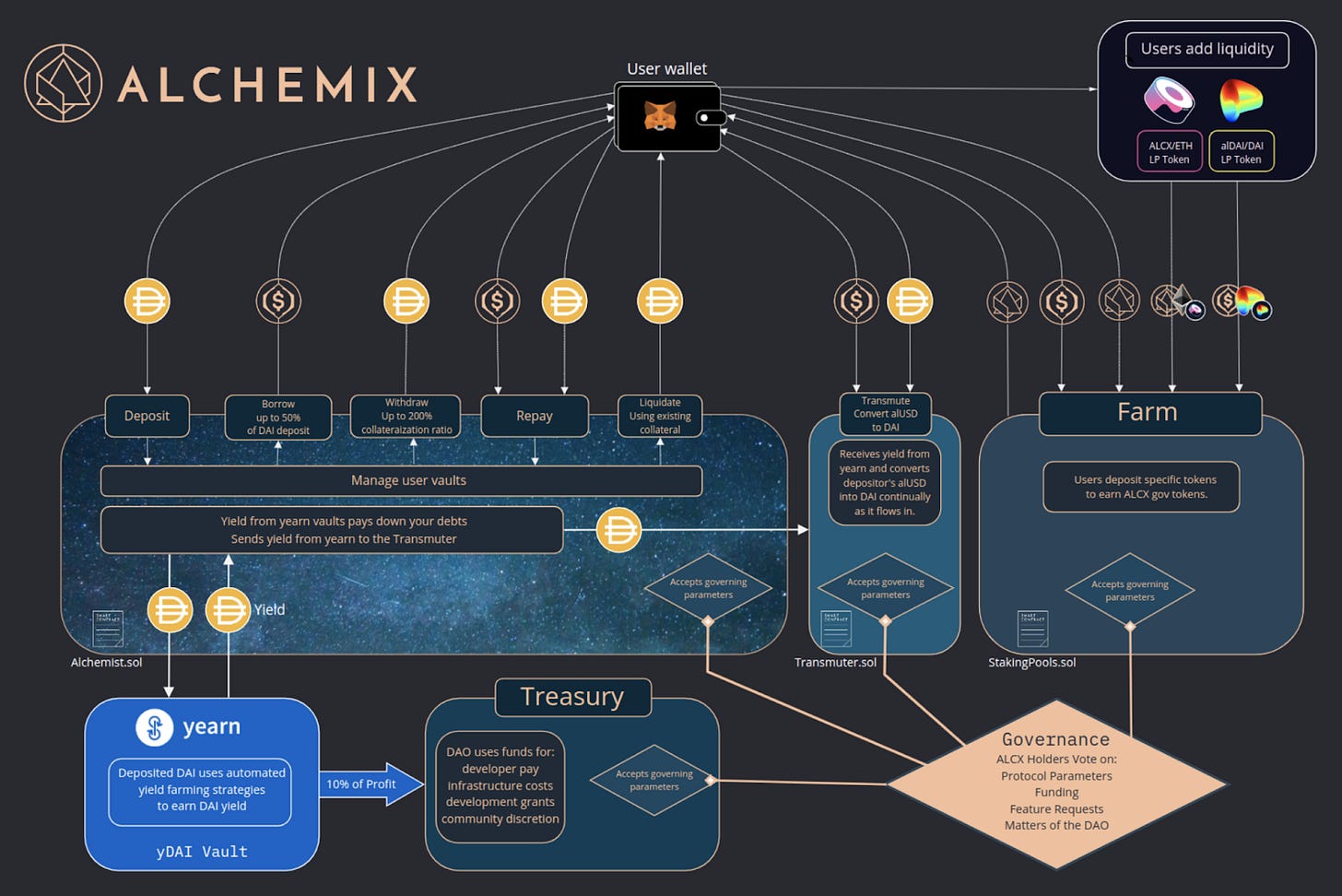

Alchemix is an overcollateralized lending protocol in which your collateral isn’t liquidated. Instead, your collateral is used to generate yield on your behalf and your loan is repaid with time.

The first version of Alchemix primarily allows you to:

Deposit DAI and borrow up to 50% in alUSD (Alchemix USD).

Your DAI is deposited into the yDAI vault from Yearn Finance.

With you alUSD you can do whatever you want.

Loans are repaid once yDAI vaults have produced enough yields.

Understanding how to cover Alchemix

Alchemix protocol and Nexus Mutual discuss the partnership.

Identify the main smart contracts to cover against.

Assuming Alchemix is audited and battle tested by the time the partnership is brought up, security audits and other details would be studied by the Nexus Mutual Risk Assessors.

Risk Assessors then stake against Alchemix’s smart contracts.

Users can buy covers if enough stakers trust Alchemix.

It is worth noting that Alchemix users depend on two protocols to be safe, one is Alchemix itself with its Transmuter which operates most of the features of the protocol. The other is Yearn Finance, since the deposits of DAI by users are used to produce yields via the yDAI vault.

Our assumption here is that users would have to pick two covers:

Cover against Yearn Finance vaults failure (since the DAI tokens are stored there to generate yields).

Cover for the Transmuter of Alchemix (not yet available)

Alchemix should complete security audits to ensure the price os their cover is attractive.

Estimation of costs for the DAO and users

A back of the envelope calculation for an Alchemix - Nexus Mutual Shield Mining program could look like this:

Alchemix has an initial 15% of total supply allocated to the DAO (~350k ALCX).

Based on other programs (estimation that Badger dedicated 75k BADGER for 12 weeks) Alchemix could offer ~$300k, ALCX 250, or ALCX 21 per week.

This Shield Mining program running for ~3 months to sweeten the deal for NXM stakers would cost a negligible amount of the Alchemix DAO treasury.

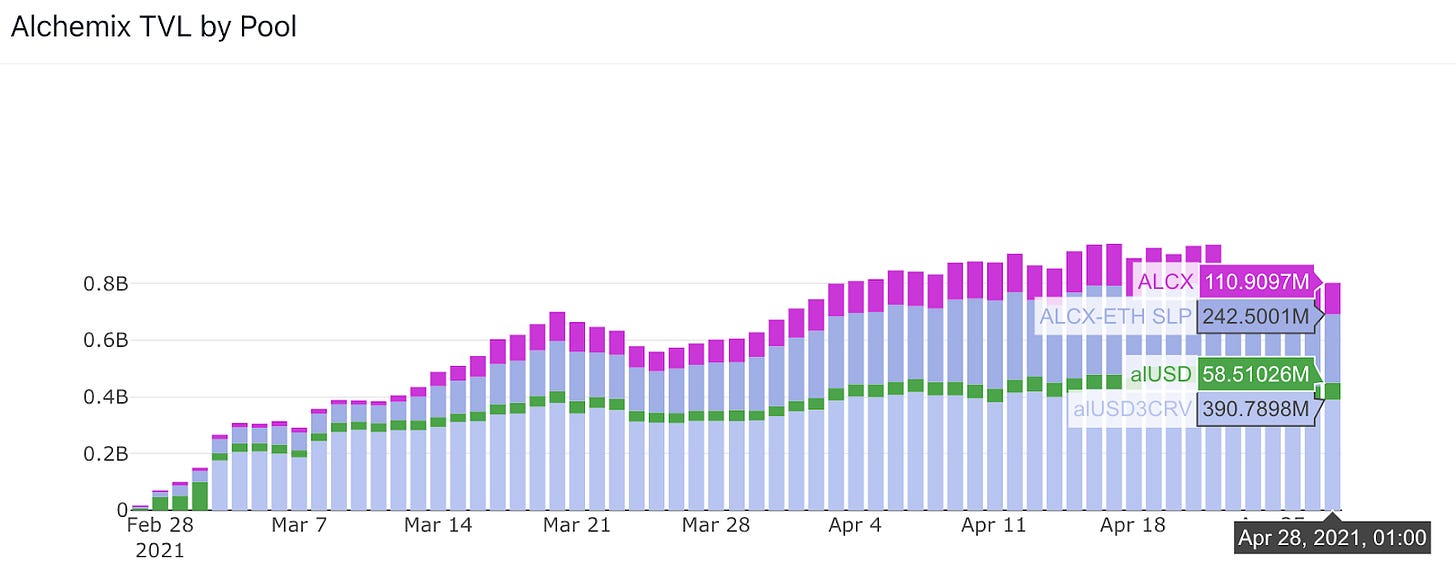

According to vfat, the estimated APRs for farming ALCX are between ~38% for alUSD and ~275% for the ALCX-ETH SLP. We can assume a cost of the cover of ~2.6% if Alchemix goes through audits and includes the Shield Mining program (to attract NXM stakers). These numbers depend on the TVL locked on Alchemix (numbers from Flipside’s Velocity BI tools), at the moment is at a sort of steady $700-800M.

It is important to note that not every Alchemix user will opt in as there’s a KYC process.

The tricky part for users that are taking loans is that they depend on yVaults for the repayment of their loans (via yields) and also depend on Alchemix’s transmuter, ie. they would have to opt into two covers (Yearn Finance + Alchemix covers), duplicating the cost.

Other types of protections: tranches

Other protocols are sort of self insured instead of opting for external providers to secure yields (they aren’t mutually exclusive though!). By tranching yield rewards, each tranche has its own risk/reward profile, risk averse yield farmers can benefit from more degen-like users that are willing to jeopardize their returns in the case of failures and subsequent exploits. Meaning those risk averse farmers would be paid before the degen users in the case something unexpected happens.

Additionally, Alchemix could store part of the yield or use its ALCX treasury if/when unexpected negative events occur.

Let’s actually dive into the main benefits and disadvantages of tranches before jumping into an example of how Alchemix could implement this strategy.

Benefits of tranching yield (ie. without Nexus Mutual)

No KYC needed (it is a requirement on Nexus Mutual).

More coverage (ie. Nexus does not cover every type of attack)

The benefits and downsides remain within the Alchemix protocol

It would probably cover up a higher % of a potential exploit

Downsides of tranching yield

Designing a coverage system that works is difficult, Nexus figured it out pretty well already

It takes dev time vs just paying some rewards to a third party provider (not that expensive?)

The DAO could always decide against paying up claims as token holders have already lost value in $ALCX as a result of the exploit and might not see an incentive in doing so.

An example of how tranches would work

If collateral (of risk averse and degen users) is into yVaults yielding ~15% APY. The yield for the risk averse tranche might be ~4.5%, while the degen tranche would earn ~19.5% (if the amount of risk averse users represents a 30% of the total vault).

While staked in the risk averse tranche, investors lock in a stable % yield and use the degen tranche as insurance in the event of a default or exploits. This is a risk those in the degen tranche knowingly take because they push for higher yields.

Saffron Finance and Barnbridge are building the infrastructure for this tranched lending. More capital in the risk averse tranche increases the implied yields for the degen tranche. The problem to be solved is understanding the demand needed to cover up for the risk averse tranche, at these protocols most of the people still choose riskier tranches.

Closing thoughts

My take is that Nexus Mutual Covers and Trenching are different types of protecting risk averse users but could also work together.

The Shield mining program by Nexus Mutual is not that expensive

It’s the users decision to opt into Nexus Mutual’s covers

An extra security option through tranches could independently be worked on by Alchemix (if they have dev resources or a partnership with Saffron/Barnbridge).

High net worth individuals (reluctant to using DeFi products initially due to the perceived risk) might be interested in getting into the self repaying (never liquidated) loans of Alchemix via these sort of insured products, that is a powerful marketing tool for Alchemix in my opinion.

Useful Documentation

Nexus Mutual Docs, Nexus Mutual Shield Mining, Alchemix Docs, Tranched Lending by Delphi, Flipside’s Velocity BI Tool, vfat tools

*Unfortunately Substack blocks many crypto related urls and I can’t include those…